Bankrate scores are objectively based on our editorial crew. Our scoring system weighs various variables consumers really should think about When picking fiscal services and products.

Editorial Observe: We make a commission from spouse one-way links on Forbes Advisor. Commissions never have an affect on our editors' viewpoints or evaluations. In case you have lousy or inadequate credit score as defined by FICO (a score of 350 to 579), you gained’t be able to qualify for a personal financial loan unless you apply having a co-signer.

Equivalent to non-public loans, vehicle financial loan qualification specifications vary for every lender and dealership. Even though we advise a least credit history rating of 670 to get by far the most favorable phrases, you could even now qualify for an automobile bank loan having a decreased score provided that you meet the debt-to-income (DTI) specifications and produce a bigger down payment.

From our solution comparison applications to award-profitable editorial content, we provide aim info and actionable following techniques to assist you make knowledgeable conclusions. It’s why about one hundred million folks set their trust in us each and every year.

On the web lenders. On the web lenders generally have far more versatile qualification specifications. Nonetheless, it’s probably this may occur on the price of increased desire charges for poor-credit borrowers.

Under you will find an inventory of the greatest small small business loans out there, particulars about Every supplying and a proof of why they built the cut.

Bankrate scores are objectively determined by our editorial team. Our scoring formula weighs quite a few things customers should really consider when choosing economic products and services.

Cycle of personal debt. In the event you roll more than your financial loan more than at the time, you could wind up racking up costs at a amount that makes it tough to repay. That is a credit card debt cycle, which can cause default. From the worst scenarios, your lender could even sue you for nonpayment.

Although Universal Credit score would make finding a personal mortgage obtainable even to Individuals with harmed credit rating, it includes some tradeoffs. To start with, it charges high APRs, well over by far the most aggressive charges noticed on our list.

Other factors, including our individual proprietary Internet site regulations and whether or not a product is offered close click here to you or at your self-picked credit rating rating array, may affect how and wherever merchandise appear on This website. Even though we try to offer a variety of offers, Bankrate won't incorporate information regarding each and every money or credit rating goods and services.

Negative credit history loans is usually a very good choice when Some others are out of get to, but they are able to come with substantial service fees. Just before accepting just one of such loans, have an understanding of the costs so you can deal with your financial debt and make informed economic selections. Popular fees incorporate:

That said, Upgrade borrowers are not subject matter into a prepayment penalty, in order to reduce the general cost of the personal loan when you’re capable to pay out it off early.

Further than presenting accessible personal financial loans, Enhance streamlines the lending procedure with a cellular application that lets borrowers view their harmony, make payments and update individual details. Upgrade’s Credit rating Heath tool also causes it to be simple to trace your credit history score about the existence of your bank loan.

In line with our evaluation of eighteen well-known lenders, Enhance presents the top personalized financial loans for terrible credit. It requires a minimum amount credit rating of 580, supplying Individuals with lousy credit rating an opportunity to safe the funding they need.

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Robert Downey Jr. Then & Now!

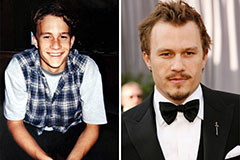

Robert Downey Jr. Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!